Effectively promoting the energy transition and contributing to a just and equitable transition - further analysis

- nrehmatulla

- Mar 19, 2025

- 2 min read

Updated: Apr 1, 2025

The IMO’s debates are considering modelling architectures, and what parameters might achieve in terms of:

GHG reductions

Promotion of the energy transition of shipping

Contributing to a just and equitable transition

This presentation is an evolution of slides delivered to informal IMO convenings from modelling done at UCL and RMI, expanding the content to explain assumptions and results in more detail.

The slides are narrated, so the slides can be looked through, or listened to, to your preference.e current measures on the table at the IMO can promote a just and equitable energy transition.

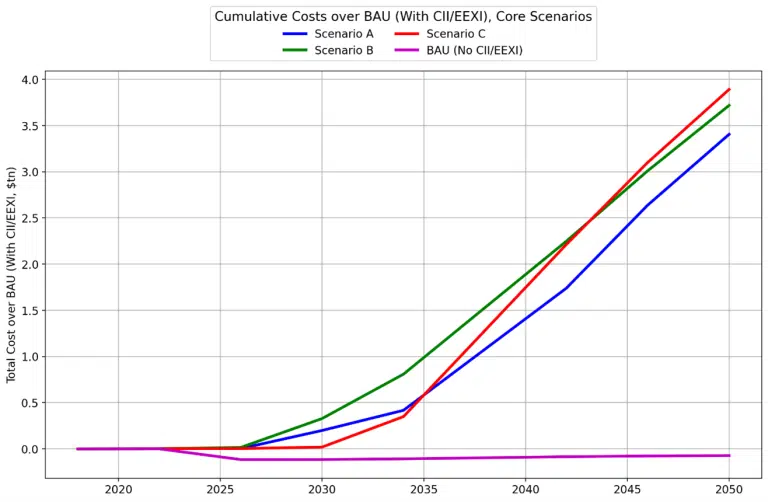

The ability of the the IMO J9 credit-trading architecture to produce a stable, investable and equitable transition relies on the assumption that most ships will be incentivised to operate on or near to the base GFI trajectory and that the large majority comply by paying the lower RU price into an IMO fund, as opposed to either buying credits (SU’s) from overperforming ships or locking in short-term incremental energy/technology - undermining much needed long-run ZNZ investment.

In another report, we share our data and method for trying to model this policy option, and investigate under which circumstances this key assumption holds – and in which circumstances the policy could actually undermine and result in failure of the IMO to reach its GHG and transition objectives. In particular we look at the uncertainties around price and carbon intensity of; LNG, CCS, Biofuels (bioethanol, biodiesel and HVO) and Wind power.

We identify 3 conditions that if satisfied would result in the failure to provide a stable revenue and investable environment for ZNZ:

Any incremental options’ carbon intensity is better (lower) than the base target (upper band)

Any incremental options’ abatement cost is below the lower remedial unit price

Any incremental options’, or combination of options’ supply can be greater than shipping’s demand for them at each point in time.

We find that in the medium likelihood scenario, only a few combinations are competitive with a lower RU price around $100/tonne CO2e, but if biofuel / LNG price drift towards their historical low or if carbon capture achieves a high rate of carbon capture, in line with the DNV’s CIA, those technologies generate cheaper credits than the lower remedial unit price and could in combination satisfy the 3 conditions – at least out to 2035, the critical initial decade for unlocking stable capital investments.

This finding further clarifies the inability of the J9 proposal to achieve IMO objectives and raise further concerns about the impact of the shipping fuel market dynamics onto bioenergy markets and both food-for-fuel risk, and shipping price volatility induced risk. The environmental integrity, the impact on the biofuel and food markets, and the ability of J9 to raise revenue are all fundamentally linked to the robustness of the as-yet-unknown LCA and sustainability guidelines and certification, and uncertain future pricing of incremental technology solutions.